Lockdown LEARNING has finally ended, and parents all-round the UK are breathing a sigh of relief for the return of a routine and no more desperate attempts to home school.

Despite the activities provided by various sources, and the hard work put in by teachers to deliver their lessons remotely, the return to school cannot come soon enough for many children and parents alike. We have explored a few ways you could save yourself a few pennies whatever the future holds for your child’s education.

Get Smart

There is no denying that to ensure your children have an education, you’re going to be spending more money. There are uniforms to buy, packed lunches to pay for, school trips and so much more. But hopefully, it’s all worth it in the end!

If you decide that you want to send your child to an independent school, then you’ll also have to include school fees in this list.

But one benefit is that growing up works on a timeline. There are those key five years before they start school where you can get saving and hopefully put enough money aside for everything they’ll need at school. You can then keep using their landmarks as your own financial guide; when they move on to secondary school, if they go to college or university etc.

If you want to send your child to private school, you’ll looking at an average cost of about £17,000 a year, and if your child does want to venture on to higher education, then you’ll likely be paying around £9,000 a year for tuition, and about the same for living costs. This does vary between where they decide to go, and what route they decide to take.

University fees may be covered by a student loan, though of course that must be paid off eventually.

Look into ways you can invest

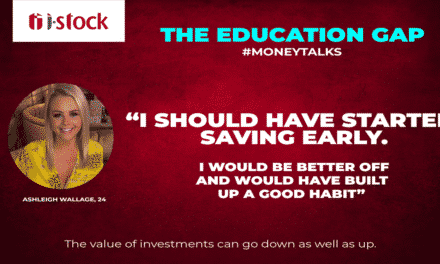

With this time frame, you might be able to start investing with a bit of risk. Regular savings accounts like Stocks & Shares ISAs offer more growth over a long period of time, with a higher interest. i-stock offers an easily accessible Stocks & Shares ISA, with no deposit or withdrawal charges, making it simple to start investing and growing your money.

Beating low income

A lot of areas offer a lot of support if you’re not earning the big bucks. These can help cover the cost of school meals, transport and uniforms.

You can also get help with the cost of extra-curricular activities to really boost your child’s experience. These benefits can come from Child Tax Credit, Working Tax Credit, Universal Credit, Income Support or Income based Jobseeker’s allowance, and can be provided by your Local Education Authority.

Get ahead of student payments

There are many ways you can save yourself a good amount as a student, such as travel cards, vouchers and discount cards and of course, getting yourself a sufficient bank and savings account. i-stock can help keep your savings afloat while you’re living student life to the full. It’s worth passing these tips on to the next generation as well. Not only are these tools a good way of saving money, but a life saver at university is the student loan. You only have to pay this back once you start earning over a certain amount after graduation and interest varies, depending on your income. If you need more information on how to survive as a student, read our “Flying the Nest” guide.

This content is published and provided for informational purposes only. The information contained within constitutes the author’s own opinions. i-stock is a trading style of Tavistock Wealth Limited which is authorised and regulated by the Financial Conduct Authority, FCA No: 568089. Tavistock Wealth do not provide financial advice. Registered Office: 1 Bracknell Beeches, Old Bracknell Lane, Bracknell RG12 7BW, Company Number 07805960. Tavistock Wealth Limited is a wholly owned subsidiary of Tavistock Investments Plc. None of the information contained in the document constitutes a recommendation that any particular investment strategy is suitable for any specific person. Source of data: Lovemoney.com, tfagroup.co.uk, Tavistock Wealth Limited unless otherwise stated.